Terminology such as Machine Learning and AI are becoming more and more part of the language used within any organisation undergoing Digital Transformation. These are often touted as the solution to all of the problems you might face in a busy Credit Control department – we prefer to be honest about this…they are not.

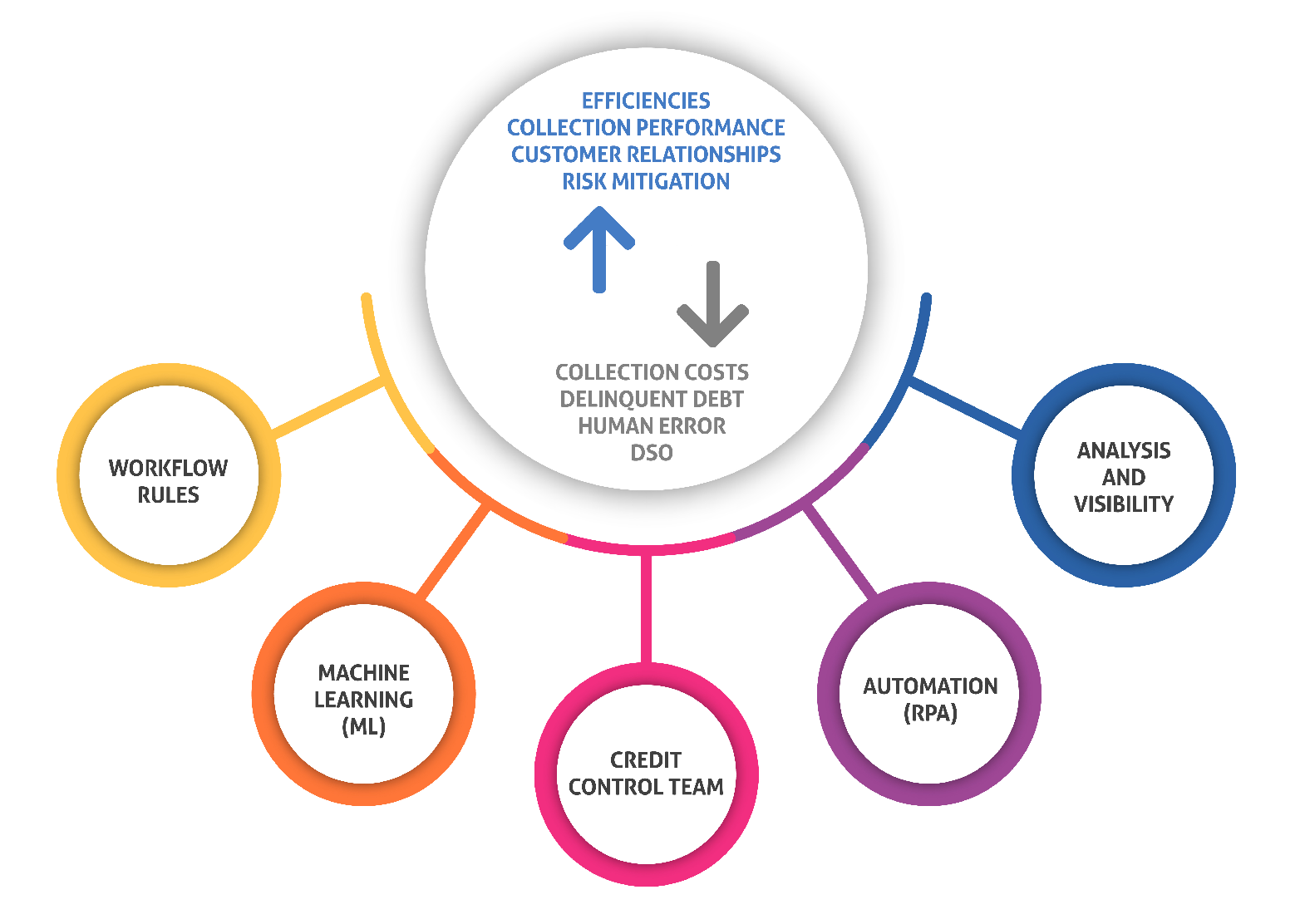

We are conscious that it is always, without exception, a human being that will be using our software. As shown above, the intelligence gathered by Machine Learning is only part of the solution to achieving great gains to your cash collection performance.

Our purpose built, highly configurable Cash Collection, Risk and Query Management system uses powerful automation and Machine Learning to ensure that all risk is being treated in the correct manner, based on behavioural analysis and flexible rules which give you full control over your debtors. Identification of customers at risk can be treated either by the RPA workflow engine, or alerted to a human to decide on what happens next. Every event is then stored forever, to allow further analysis and decisions made based upon a customers’ previous behaviour – eliminating guesswork and ‘gut feeling’.

Giving you clarity and certainty.

Just a handful of examples of Credica Machine Learning are:

- Alerts of Customers’ propensity to fail their promise-to-pay

- Analysis of Credit Scoring trends, and alerts for downwards trends

- Information regarding Customers’ typical behaviour to query invoices

- Credit limit warnings from internal and external (e.g. Creditsafe) sources of information

- DSO trending, and alerts for alarming patterns or trends

Primarily, our products are designed to be user-friendly. Machine Learning won’t get your work done for you, but it can empower your Credit Control to be more effective. They will always need a fast, user friendly system to reach their full potential for your organisation.